Condo Insurance in and around Clinton

Clinton! Look no further for condo insurance

Protect your condo the smart way

Condo Sweet Condo Starts With State Farm

As with anything in life, it is a good idea to expect the unexpected and strive to prepare accordingly. When owning a condo, the unexpected could look like damage to your unit and personal property inside from smoke fire, lightning, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Clinton! Look no further for condo insurance

Protect your condo the smart way

Agent Josh Foust, At Your Service

You can rest assured with State Farm's Condo Unitowners Insurance knowing you are prepared for the unexpected with dependable coverage that's right for you. State Farm agent Josh Foust can help you discover all the options, from liability, possible discounts to replacement costs.

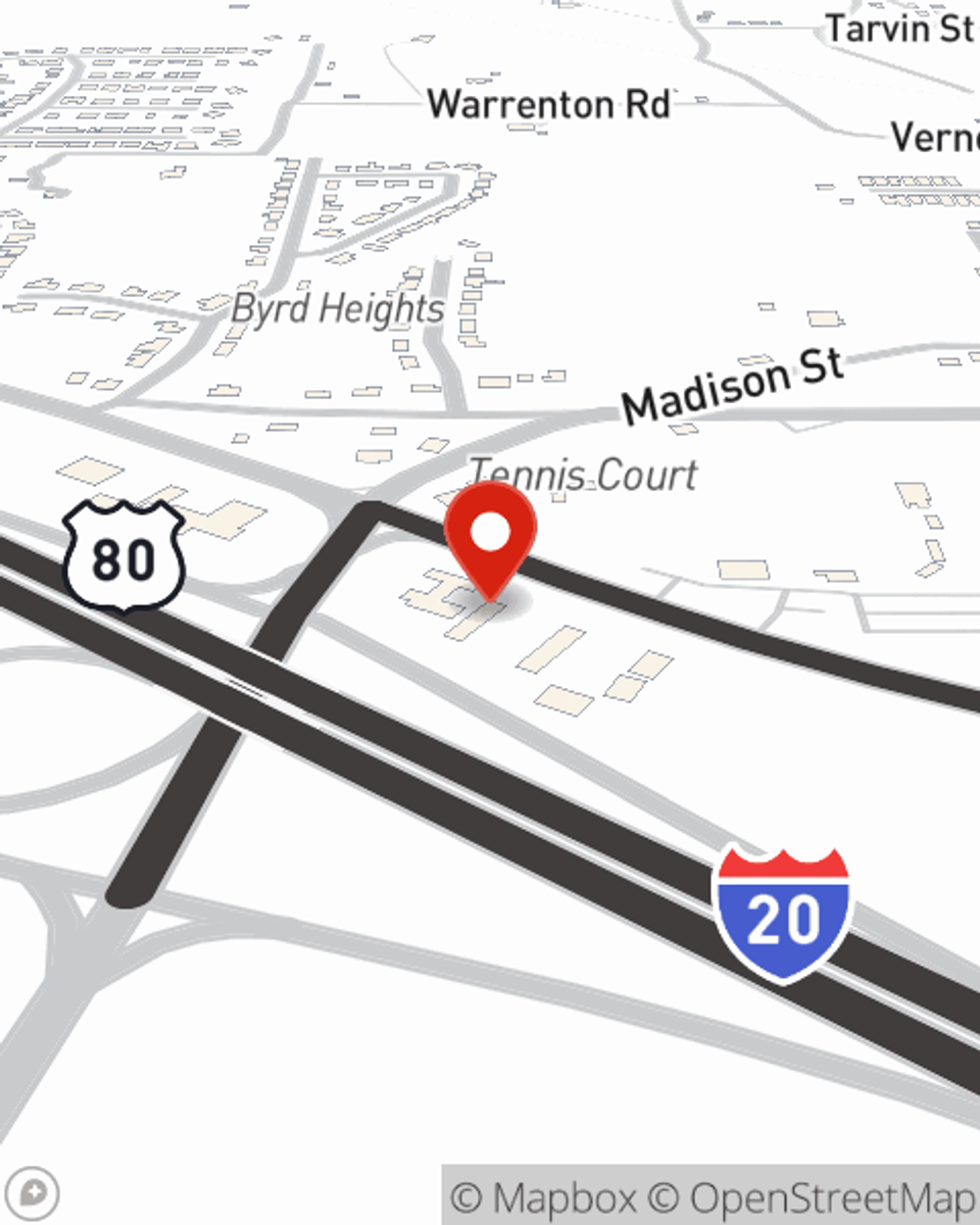

If you want to ask any questions, State Farm agent Josh Foust is ready to help! Simply call or email Josh Foust today and say you are interested in this excellent coverage from one of the leading providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Josh at (601) 924-6106 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.